Cyber Liability is a stand-alone insurance policy that covers 1st party and 3rd party damages and expenses associated with lawsuits brought about from cybersecurity risk. These risks include:

- 1st and 3rd Party Funds Transfer Risks: What is the difference? Here is a post we created to explain it. Here is an example of 3rd party.

- Internet Media Liability: Click here to read about this valuable protection.

- 24-7 Access to a Data Breach Coach: your main point of contact once a breach is suspected. He or she is available through this policy to provide consultative and legal services to help you manage a breach event. If you suspect a cyber breach you call them, if it turns out to be nothing, better safe than sorry.

- Forensic Services: to determine the cause and scope of your data breach together with the cost and resources to review your rights in the case of a breach at any of your IT services providers.

- Breach Notifications: the cost to notify all breached persons and comply with regulatory communications requirements which seem to be getting more complex as the occurrences of cyber breaches become more widespread.

There are several other cyber coverage features in addition to the above-mentioned, but those are the ones we get asked about the most.

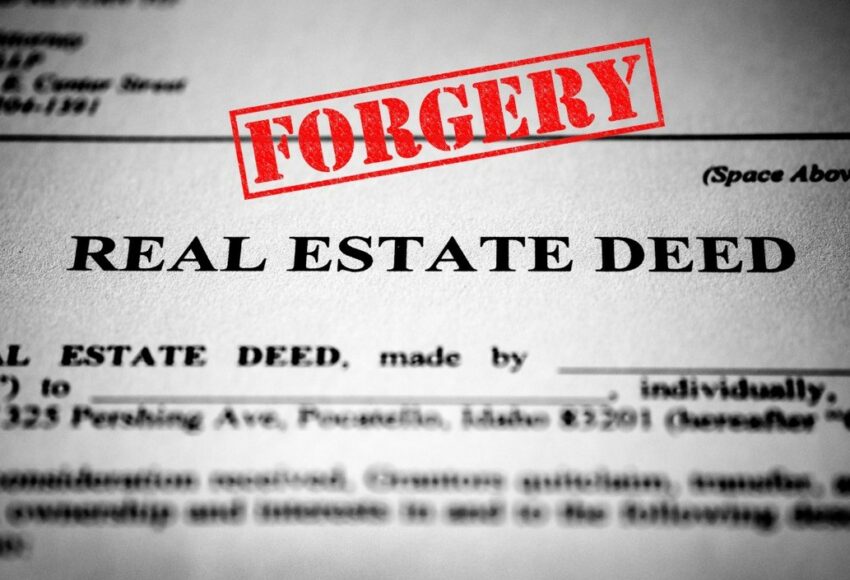

Our Cyber Liability for real estate blog is designed to be a repository for useful risk management information that can help real estate professionals stay informed and increase their cyber awareness. We believe a combination of proactive risk management together with a quality insurance policy is the best way to provide maximum protection against this very concerning and serious threat.

Next Steps:

If you are interested in a cyber liability quote for a policy that covers these risks and others important to real estate professionals, please click here to get started by answering 10 basic questions or call (443) 502-5645