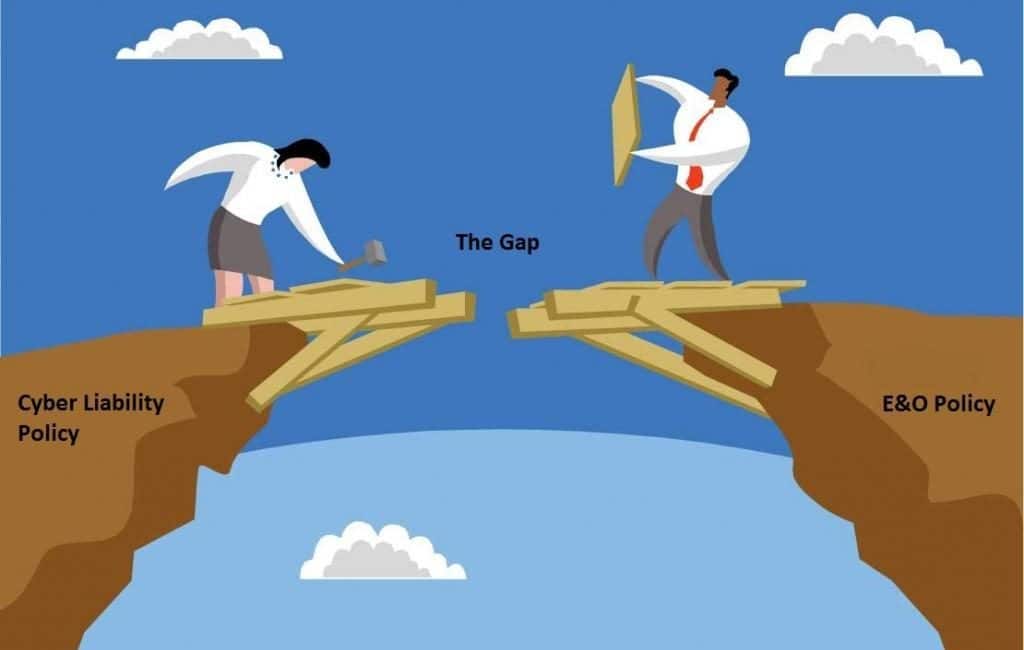

There is a little-known gap that exists between E&O policies and Cyber liability policies, which in our opinion is a worthwhile talking about.

E&O Insurance policies trigger coverage for various situations but almost all of them exclude 3rd party funds lost via wire transfer.

Now here is the gap situation… a bad actor contacts the real estate agent masquerading as the title person, closing attorney or someone else involved in the closing, and shares funding instructions for the wire transfer via email, text or voice. The real estate agent forwards these fraudulent funding instructions to their client who compiles with them and now that money is gone. The client sues the real estate agent for instructing them to send their money to the wrong place. E&O does not coverage it because it is lost funds via wire transfer and cyber does not coverage it because there is no cyber breach of the insureds computer systems that lead to the lost.

Cyber Liability policies trigger 3rd party liability coverage based on the presence of a cyber breach event that allows bad actors to gain access to valuable information to harm a client of yours. The most common version of this is the famous and all too popular wire transfer fraud email / telephone scam where closing information is stolen and “last minute” instructions to direct funds to a false bank account are emailed to your client as if the email is coming from their real estate agent. If the money is lost this situation is covered in many cyber liability policies.

This exact gap is NOW covered by PBI Group’s policy. If you are interested in a quote contact us today.

* Every coverage situation is different, and the final outcome depends on the unique facts, law and insurance policy involved. The E&O policy contains reductions, limitations, exclusions and termination provisions that impact coverage for a specific event. Full details of the coverage are contained in the policy